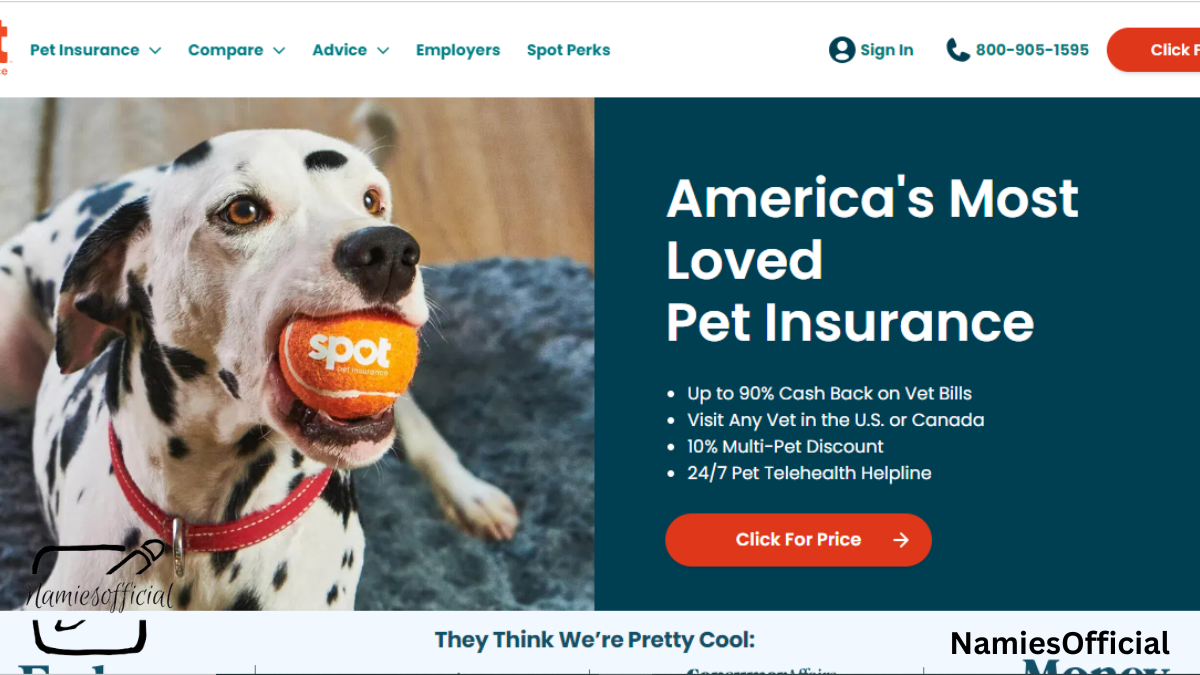

When it comes to safeguarding our furry friends, pet insurance is an option many pet owners consider. Spot Pet Insurance is one of the leading providers in the industry, offering a variety of plans to cater to the diverse needs of pets and their owners. But how do you know if Spot Pet Insurance is the right choice for you? In this comprehensive review, we will delve deep into the details of Spot Pet Insurance, from its coverage options and costs to customer reviews and comparisons with other providers.

Understanding Pet Insurance

Pet insurance is a form of health insurance designed specifically for pets. Just like human health insurance, pet insurance helps cover the cost of medical care, ensuring that pet owners are not overwhelmed by unexpected veterinary bills. The importance of pet insurance cannot be overstated, as it provides peace of mind knowing that your pet can receive the best care without the worry of financial strain.

Spot Pet Insurance Coverage Options

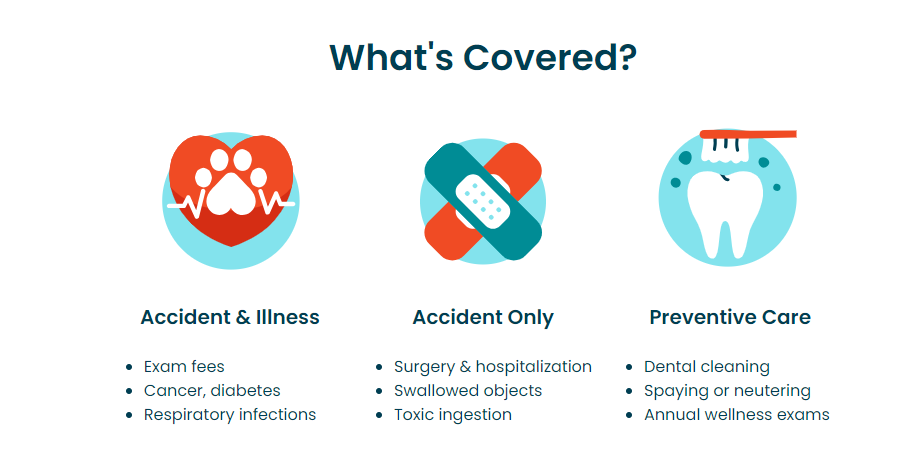

Spot Pet Insurance offers a range of coverage plans tailored to meet the needs of different pets and their owners:

Accident-Only Coverage

This plan is designed to cover unforeseen accidents, such as broken bones, poisonings, and injuries. It’s an ideal option for pet owners who want a more affordable plan while still providing protection against unexpected mishaps.

Accident and Illness Coverage

The Accident and Illness plan is a more comprehensive option, covering both unexpected accidents and illnesses, including hereditary and chronic conditions. This plan is perfect for pet owners looking for more extensive coverage.

Wellness and Preventative Care Options

Spot Pet Insurance also offers optional wellness and preventative care add-ons. These options help cover routine care such as vaccinations, dental cleanings, and flea prevention. While these add-ons increase the premium, they ensure your pet’s routine care is also covered.

How Spot Pet Insurance Works

Enrollment Process

Getting started with Spot Pet Insurance is straightforward. You can enroll your pet online by providing basic information about your pet and choosing a plan that fits your needs. There are no upper age limits for enrollment, which makes it accessible for pets of all ages.

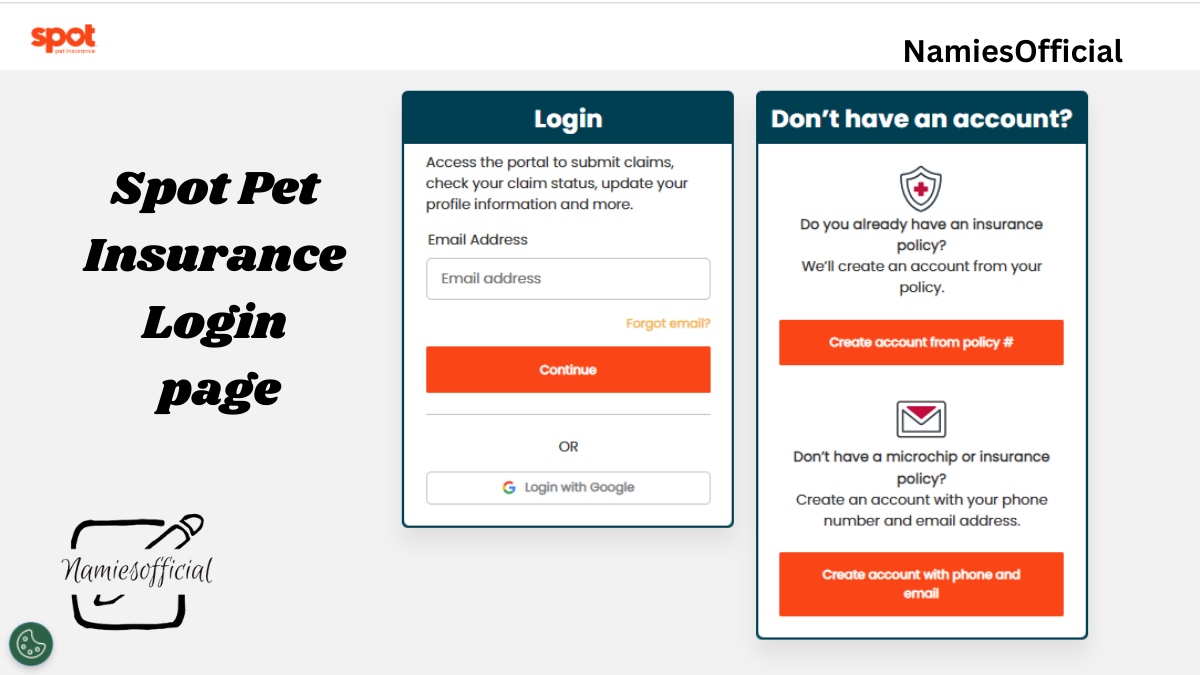

How to File a Claim

Filing a claim with Spot Pet Insurance is a hassle-free process. You simply need to upload a copy of the vet bill and fill out a brief claim form through their online portal. Spot aims to make the claim process as transparent and quick as possible.

Reimbursement Process and Timelines

Once a claim is submitted, Spot Pet Insurance typically reimburses the policyholder within a few weeks, depending on the complexity of the claim and the documentation provided. Reimbursement rates can vary, but policyholders can choose a percentage during the enrollment process, allowing for some customization of the plan.

Cost of Spot Pet Insurance

Factors Affecting Premium Costs

The cost of pet insurance with Spot can vary based on several factors, including the pet’s age, breed, and location. Additionally, the type of coverage and deductible chosen will impact the overall cost.

Average Cost of Spot Pet Insurance

On average, pet owners can expect to pay between $20 and $45 per month for a cat and $30 to $75 per month for a dog, depending on the coverage level and deductible.

Comparing Costs with Other Providers

Compared to other pet insurance providers, Spot’s pricing is competitive, especially considering the breadth of coverage options available. It’s essential to compare not only the cost but also the coverage details to ensure you’re getting the best value for your money.

Pros of Choosing Spot Pet Insurance

- Comprehensive Coverage Options: Spot offers a wide range of coverage options, from basic accident-only plans to comprehensive accident and illness plans.

- Customizable Plans: Pet owners can tailor their insurance plan to fit their budget and their pet’s needs, selecting different levels of coverage, deductibles, and reimbursement rates.

- No Age Limit for Enrollment: Unlike some other insurers, Spot does not have an age limit for enrolling pets, making it a viable option for older pets.

Cons of Spot Pet Insurance

- Common Complaints from Customers: Some customers have reported delays in the claims process and difficulties in getting reimbursed for certain treatments.

- Limitations and Exclusions in Policies: Like all insurance providers, Spot has certain exclusions, such as pre-existing conditions and specific breed-related illnesses.

- Waiting Periods: There are mandatory waiting periods before coverage begins, which some pet owners find inconvenient.

Customer Reviews and Experiences

Positive Customer Reviews

Many customers appreciate Spot’s comprehensive coverage options and easy-to-use online portal for managing their policies and claims. The flexibility to customize plans is another frequently mentioned benefit.

Negative Customer Feedback

On the flip side, some customers have noted dissatisfaction with the speed of the claims process and the clarity of communication regarding policy exclusions.

Analysis of Common Themes in Reviews

A recurring theme in customer reviews is the importance of understanding the policy terms thoroughly before enrolling. Many negative reviews stem from misunderstandings about what is covered and the associated waiting periods.

Comparison with Other Pet Insurance Providers

Spot Pet Insurance vs. Healthy Paws

Healthy Paws is known for its unlimited lifetime coverage with no caps on claims. However, Spot provides more flexibility with its customizable plans and wellness add-ons, which Healthy Paws does not offer.

Spot Pet Insurance vs. Trupanion

Trupanion offers a unique 90% reimbursement rate and no payout limits. However, Spot’s wellness and preventative care options provide additional coverage not available with Trupanion.

Spot Pet Insurance vs. Embrace

Embrace Pet Insurance is known for its diminishing deductible feature, where the deductible decreases each year you don’t file a claim. Spot, however, offers more flexibility in terms of plan customization and additional wellness coverage.

Tips for Choosing the Right Pet Insurance

- Assessing Your Pet’s Needs: Consider your pet’s breed, age, and typical health issues when choosing a plan.

- Understanding Policy Terms and Conditions: Read the fine print to know exactly what is covered and any exclusions that may apply.

- Importance of Reading Customer Reviews: Customer experiences can provide valuable insight into the reliability and service quality of the insurer.

How to Maximize Your Spot Pet Insurance Plan

- Utilizing Wellness Benefits: Take full advantage of wellness benefits to cover routine care and keep your pet healthy.

- Choosing the Right Deductible: A lower deductible means higher premiums but can be beneficial if you expect frequent visits to the vet.

- Regularly Reviewing Your Policy: Stay informed about any changes to your policy and adjust your coverage as needed.

Is Spot Pet Insurance Right for You?

Spot Pet Insurance may be an excellent choice for pet owners looking for flexible, comprehensive coverage with the option to add wellness benefits. However, it’s crucial to weigh the pros and cons and consider your pet’s specific needs before making a decision.

How to Apply for Spot Pet Insurance

Step-by-Step Application Process

- Visit the Spot Pet Insurance website.

- Enter your pet’s details, such as age, breed, and medical history.

- Choose a plan that fits your needs and budget.

- Submit the application along with any required documentation.

- Wait for the confirmation of your policy enrollment.

Documents Needed for Enrollment

You’ll need your pet’s medical records and possibly vaccination history, depending on the plan chosen.

How soon can I use my Spot Pet Insurance after enrolling?

Coverage begins after the mandatory waiting periods, which are typically a few days for accidents and a few weeks for illnesses.

Are there any breed-specific restrictions?

No, Spot Pet Insurance does not have breed-specific restrictions, but certain hereditary conditions may not be covered.

How do I update my pet’s information?

You can update your pet’s information through the online portal or by contacting customer service.

What is the cancellation policy?

Spot offers a flexible cancellation policy with a full refund if canceled within the first 30 days and no claims have been filed.

Can I change my plan after enrolling?

Yes, you can change your plan at any time by contacting customer service, but changes may affect your premium.

Conclusion

Spot Pet Insurance offers a variety of plans to cater to different needs and budgets, with a focus on flexibility and comprehensive coverage. While it has its pros and cons, it remains a solid choice for pet owners looking to ensure their furry friends are covered in case of accidents or illnesses. By carefully reviewing the options and understanding the policy terms, you can make an informed decision that best suits your pet’s needs.